Understanding of an Estonian e-Notary Service Step by Step

If you’re wondering, “e-Notary in Estonia how it works?” You’ve come to the right place. Estonia is leading the way in digital notarization, and their e-Notary system is an excellent example of this.

Digital notarization is a process that allows documents to be signed and authenticated electronically, without requiring the physical presence of a notary public. Estonia’s e-Notary system takes this a step further by allowing notarial acts to be performed entirely online, including the verification of identities and the signing of documents.

The e-residency program, which allows non-residents to access Estonian online services and conduct business remotely, has further expanded the reach and convenience of the e-Notary system.

So, how exactly does e-Notary in Estonia work? Let’s explore the details.

Key Takeaways:

-

-

- Estonia’s e-Notary system allows notarial acts to be performed entirely online.

-

- The system includes the verification of identities and the signing of documents.

- The e-residency program allows non-residents to access the e-Notary system and conduct business remotely.

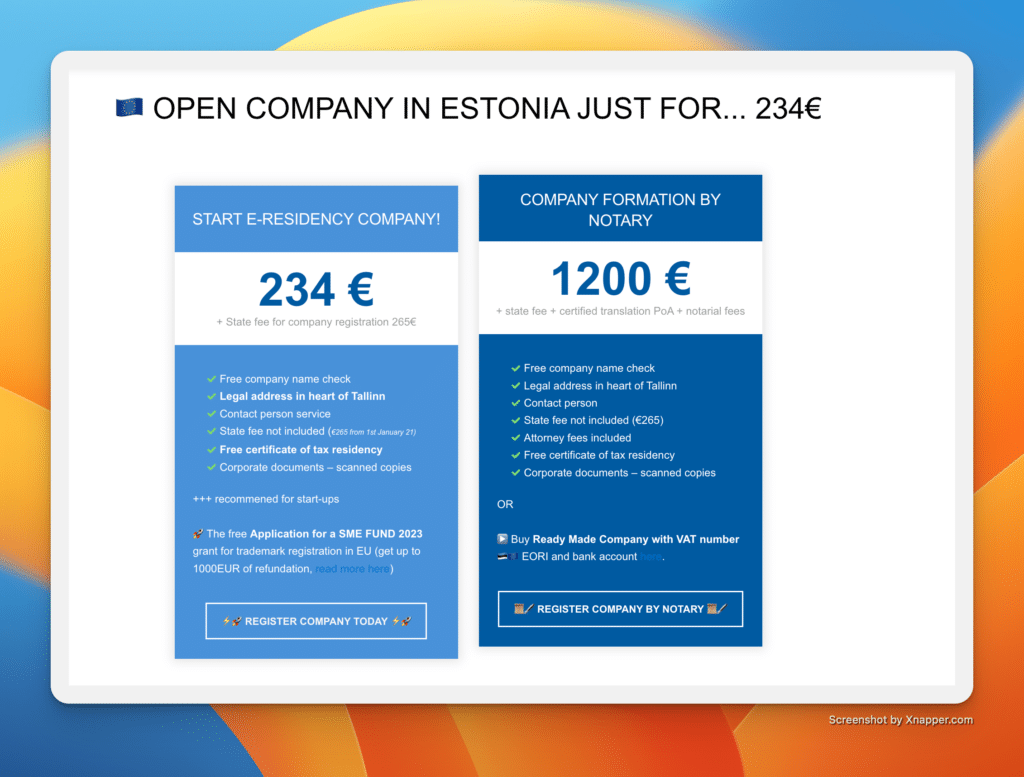

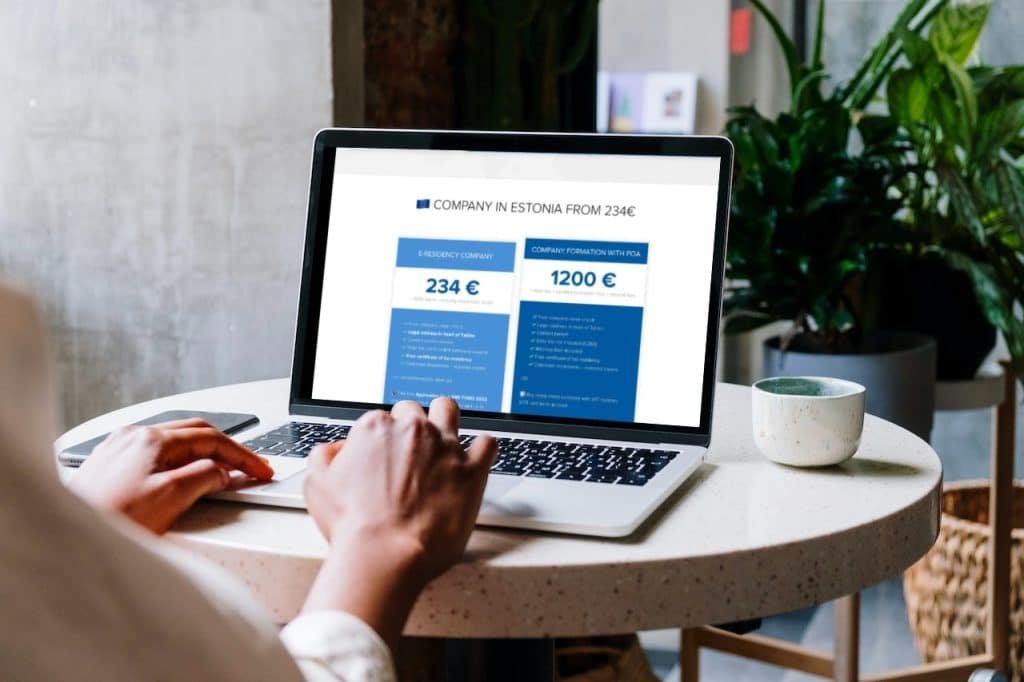

Purchase Ready made EU company or Register a company by Notary here.

The Importance of Notarial Services

In today’s digital age, online notary services have become increasingly important. A notary public is an official witness to the signing of legal documents and provides an added layer of authenticity and security to transactions. Their role is particularly crucial in areas such as real estate, finance, and law.

Notarial services also offer protection against fraud and ensure that the signatories are who they claim to be. They are responsible for verifying the identity of the signatories and ensuring that they are signing the document of their own free will.

One significant development in the world of notarial services is the emergence of digital signatures. These signatures, which are created using encryption technology, provide an added layer of security to transactions in the digital realm. They are tamper-proof, making them a valuable tool for protecting against fraud and ensuring the integrity of legal documents.

“Notarial services are crucial for ensuring the authenticity and security of legal transactions, especially in the digital age with the rise of online notary services.”

“Online notary services are rapidly growing in popularity, providing a convenient and efficient solution for those in need of notarial services.”

Introduction to e-Notary in Estonia

Electronic notarial acts or e-Notary in Estonia is a system that allows notarial services to be conducted digitally. With the emergence of the digital age, Estonia has taken the lead in streamlining notarial processes through digital notarisation.

All notarial services previously conducted face-to-face can now be carried out remotely through this digital system. This has revolutionized the traditional notary system, making it more convenient and accessible for people from around the world.

Estonia’s e-Notary system is a secure and efficient way to provide notarial services. It has been welcomed by many as a solution to the challenges of traditional paper-based notarial processes.

“Digital signatures and electronic notarial acts have transformed the notarial landscape in Estonia, leading the way for other countries in the world.”

Electronic notarial acts have the same legal effect as traditional notarial acts. They are done exclusively through a secure online platform, which ensures the authenticity and integrity of the documents.

E-Notary in Estonia allows for the creation, authentication, and certification of documents in electronic form, making it an ideal solution for individuals and businesses that operate remotely or across borders.

The digital notarization process in Estonia is quick and efficient and is an essential part of the country’s innovative e-governance system. It has transformed notary services and made them more accessible and efficient, providing a cost-effective and secure way of notarizing documents.

Electronic Notarial Acts

Electronic notarial acts or ENAs are digital documents that are signed and stored electronically. They are used in e-Notary in Estonia and have legal significance in the same way as traditional, paper-based notarial acts.

Their validity is guaranteed by the Estonian State, which has put in place a legal framework to govern the use of electronic notarial acts. Through this framework, electronic notarization is recognized as a secure and authentic way to conclude various legal transactions.

E-Notary in Estonia has made electronic notarial acts an integral part of the notarial system, which has transformed notary services in the country. Estonia’s advanced digital infrastructure has made it possible to create, certify and preserve electronic notarial acts, making the entire process smooth and straightforward.

As such, electronic notarial acts have eliminated the need for physical presence during notarization. With e-Notary in Estonia, individuals and businesses can efficiently notarize their documents from any part of the world.

Digital Notarization

Digital notarisation is a process that involves the creation and certification of digital documents. It is conducted through a notary public, who is a licensed professional authorized by the Estonian Government to oversee the process of digital notarization.

The notary public’s role is to verify the identity of the parties and ensure the authenticity and integrity of the documents. In e-Notary in Estonia, notaries work with electronic notarial acts and digital signatures, which provide a secure and efficient way of creating and certifying documents.

Digital notarization has made notarial services accessible and efficient, providing a cost-effective and secure way of notarizing documents. It has eliminated the need for paperwork and reduced the time it takes to notarize documents.

E-Notary in Estonia is leading the way in digital notarization, providing a secure, efficient, and innovative solution to traditional notarial processes.

e-Residency and Notary Services

One of the unique benefits of e-residency is the ability to access the innovative notary services offered by Estonia’s modern notary public system. E-residents can enjoy the convenience and efficiency of digital notarization services from anywhere in the world, without having to physically travel to Estonia.

Moreover, notarized documents hold legal authenticity and provide a higher level of security in cross-border transactions, making them a crucial component of international business operations. The Estonia notary system is recognized across the EU and globally, making it an ideal solution for businesses looking to expand their reach.

With the Estonian notary system, e-residents can access a wide range of notarial services, including digital signatures, remote notarization, and electronic notarial acts. These services are available through various online platforms, including the e-Notary portal, which allows e-residents to complete notarial acts via video conferencing.

“As an e-resident, the ability to access notary services online saves me time and money. The process is straightforward, and I can complete notarial acts from the comfort of my home or office in the UK.” – John, a UK-based e-resident

e-Residency and Notary Services for Businesses

E-residency combined with the Estonian notary public system provides businesses with an attractive and cost-effective solution that streamlines cross-border transactions. It allows businesses to complete a range of notarial acts, including property transactions, share transfers, and the authentication of legal documents without ever leaving their home country.

Moreover, the Estonian notary system offers a unique advantage for e-resident businesses as it is recognized across the EU and beyond, providing a secure and reliable solution for notarizing documents. This also gives e-resident businesses a competitive edge, enabling them to expand their operations and reach new markets.

Therefore, e-residency combined with the Estonian notary system provides a hassle-free and cost-effective solution for businesses looking to operate beyond their home country’s borders.

The Process of e-Notary in Estonia

Remote notarization has become more prevalent in recent years, especially with the rise of digitalization and the need for efficient online services. In Estonia, e-Notary has been in place since 2000, and the process is straightforward and secure.

Step 1: Confirm Identity

The first step in the process of e-Notary is to confirm the identity of the parties involved. This can be done through the use of electronic identification, which is linked to the Estonian national identity database and allows for secure and efficient online authentication.

Step 2: Choose a Notary

Next, the parties must choose an Estonian notary to perform the notarial act. The Estonian Chamber of Notaries website provides a list of notaries available for remote notarization, allowing parties to choose a notary who specializes in their specific type of transaction. Don’t know which notary is suitable for your transaction? Hire Eesti Consulting.

Step 3: Connect Online

Once a notary has been selected, the parties can connect online through a video conferencing platform. The notary will confirm the identity of the parties once again before proceeding with the notarial act.

Step 4: Sign the Document Digitally

After the identity of the parties has been confirmed, the notary will provide the document for e-signing. The document can be signed digitally, using qualified electronic signatures that are recognized in the EU and in many other countries worldwide.

Step 5: Notarize the Document

Once the document has been signed, the notary will notarize it electronically using a secure digital seal. This seal ensures the authenticity and integrity of the document, providing legal validity and recognition.

“e-Notary in Estonia has made notarial services more accessible and convenient for clients, allowing them to complete transactions from anywhere in the world,” said Merle Saar-Johanson, a notary public in Estonia.

e-Notary in Estonia has revolutionized traditional notarial processes, offering a streamlined and secure way to complete notarial acts remotely. With the use of digital signatures and electronic notarial acts, parties can sign and notarize documents from anywhere in the world, saving time and money. This process has become increasingly important in the current climate, where remote transactions are becoming the norm.

Advantages of e-Notary in Estonia

When it comes to notarial services, Estonia has embraced the digital era, providing its citizens and e-residents with the convenience and accessibility of e-Notary services. Digital notarization has revolutionized traditional notarial processes, offering a range of benefits over the traditional in-person method.

One of the major advantages of e-Notary in Estonia is the accessibility of virtual notary services. With electronic notarial acts, notarial services can be easily accessed remotely, without the need for physical presence. This makes the process more efficient and cost-effective for both parties involved.

Furthermore, virtual notary services can be conducted at any time, as long as both parties have access to an internet connection and the necessary equipment. This is particularly useful for individuals who are unable to attend in-person notary services due to geographical or logistical limitations.

In addition, digital notarization offers increased security for both parties involved. With electronic notarial acts, documents can be signed and notarized securely, and the authenticity of the notarized documents can be easily verified. This reduces the risk of fraud or manipulation, providing greater legal protection for all parties involved.

“Estonia has set a benchmark with its e-Notary system, providing a convenient and secure way of accessing notarial services. The virtual notary services offered by the Estonian notary system are a game-changer, enabling anyone with an internet connection to have their documents notarized remotely.”

With the growth of global business and the rise of remote work, e-Notary in Estonia has become an increasingly valuable tool for international transactions. With digital notarization, businesses can easily conduct transactions across borders, without the need for physical presence.

Overall, e-Notary in Estonia offers a range of advantages over traditional notarial services. The accessibility, security, and convenience of digital notarization make it an attractive option for individuals and businesses alike.

Validity and Recognition of e-Notarized Documents

One of the biggest concerns with e-Notary in Estonia is the validity and recognition of digitally notarized documents. However, the Estonian government has taken steps to ensure that e-notarized documents hold the same legal weight as traditional paper documents.

The legal framework surrounding e-Notary in Estonia is governed by the Digital Signatures Act and the Notaries Act. These acts provide a clear definition of electronic notarial acts and outline the legal requirements for their use.

Notarized documents in Estonia are also recognized internationally under the Hague Convention of 5 October 1961 Abolishing the Requirement of Legalisation for Foreign Public Documents. This means that e-notarized documents can be accepted in various jurisdictions without the need for further authentication.

It’s important to note that the recognition of e-notarized documents may vary depending on the laws of the specific jurisdiction. However, as e-Notary and digital notarization continue to gain acceptance and popularity, it’s likely that more jurisdictions will adopt similar legal frameworks to ensure the validity and recognition of electronically notarized documents.

Overall, the validity and recognition of e-notarized documents is a crucial aspect of the e-Notary system in Estonia. With a robust legal framework and international recognition, individuals and businesses can trust that their electronically notarized documents hold the same legal weight as traditional paper documents.

The Future of e-Notary

As technology continues to progress, it is likely that e-Notary services in Estonia will evolve to become even more efficient and accessible. One potential area of development is the use of blockchain technology to create an even more secure and tamper-proof system for digital notarization. This could help to further increase the trust in e-Notary services and make them even more widely accepted.

Another possible development is the expansion of virtual notary services, which could lead to a more flexible and convenient system for completing electronic notarial acts. With the increasing popularity of remote work and online transactions, this could prove to be a significant advantage for individuals and businesses alike.

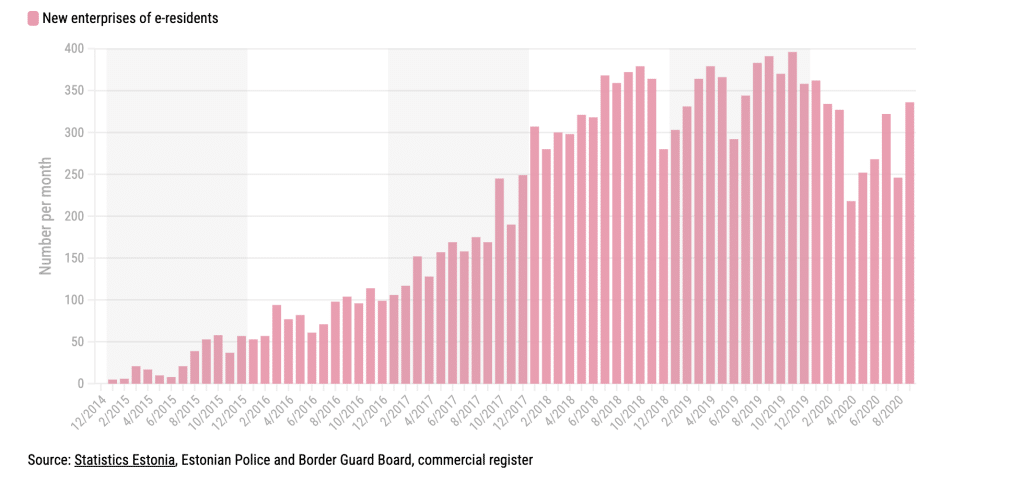

The Impact of COVID-19

The COVID-19 pandemic has highlighted the importance of digital solutions, and e-Notary services in Estonia have been no exception. With social distancing measures and restrictions on physical contact, the ability to complete notarial acts remotely has been crucial. This has led to a surge in demand for e-Notary services, and has also demonstrated the resilience of the Estonian notary system.

“The COVID-19 pandemic has accelerated the development of digital solutions, and the Estonian notary system has proven to be well-equipped to handle the increased demand for online notarization services.”

Overall, the future of e-Notary in Estonia looks promising, with the potential for further advancements in technology and a continued commitment to providing efficient and secure notarial services. The convenience of virtual notary services and the reliability of electronic notarial acts make e-Notary an attractive option for those seeking legal authenticity in the digital age.

Exploring E-Residency and e-Notary Opportunities

Estonia’s e-residency program has become a popular option for individuals and businesses looking to expand their international capabilities. With e-residency, you can establish and manage a company in Estonia entirely online, without the need for physical presence. This has become particularly useful in the global pandemic era, where travel has become increasingly restricted.

One of the key advantages of e-residency is the seamless integration with Estonia’s digital notarization system. By obtaining e-residency, you can easily access and use e-Notary in Estonia for various legal transactions, such as contracts and agreements. This eliminates the need for physical notarization, saving you time and money.

Moreover, e-Notary in Estonia offers remote notarization services, allowing you to complete notarial acts from anywhere in the world. This can be done through online platforms and video conferencing, ensuring security and authentication of the document.

The combination of e-residency and e-Notary in Estonia opens up a world of opportunities for cross-border transactions and international business operations. With the ability to establish and manage a company in Estonia, as well as access digital notarization services, you can expand your business globally without the traditional barriers of physical presence and paperwork.

Overall, e-residency and e-Notary in Estonia have proven to be a game-changer for individuals and businesses looking to operate efficiently and effectively in the digital age. By embracing digital innovation and streamlining traditional notarial processes, Estonia has become a leading example in the world of e-government and digital transformation.

“The combination of e-residency and e-Notary in Estonia opens up a world of opportunities for cross-border transactions and international business operations.”

Conclusion

In conclusion, e-Notary in Estonia represents a major leap forward in the digital age. With digital notarization, electronic notarial acts, remote notarization and virtual notary services, Estonia has established an efficient and secure notary system that is accessible to everyone. By embracing the opportunities of e-residency and digital innovation, Estonia has created a framework for cross-border transactions and international business operations that is hard to beat.

It is clear that e-Notary in Estonia has enormous potential for the future. With the development of new technologies and the ongoing improvements in virtual notary services, the possibilities are virtually limitless. And by leveraging the power of e-residency, individuals and businesses around the world can benefit from this innovative system. Whether you are a resident or a non-resident, e-Notary in Estonia is a game-changer that is well worth exploring.

Questions ans Answers

e-Notary

e-Notary in Estonia is a digital notarization system that allows individuals and businesses to complete notarial acts online, eliminating the need for physical presence at a notary’s office.

The notary public in e-Notary acts as a trusted third party who verifies the identity of the parties involved, ensures the authenticity of the documents, and provides legal validation to the notarized acts.

Estonia’s e-residency program allows individuals to establish an online presence in Estonia, enabling them to access various digital services, including e-Notary. This provides convenience, efficiency, and access to the Estonian notary system from anywhere in the world.

e-Notary streamlines traditional notarial processes by digitizing the entire process, reducing the need for physical paperwork and in-person meetings. It offers convenience, accessibility, and faster turnaround times for notarizing documents.

Yes, e-residents can benefit from the Estonian notary system by utilizing e-Notary services. They can remotely notarize documents, create legally binding agreements, and access other notarial services offered by Estonia’s digital platform.

Remote notarization in e-Notary involves the use of online platforms, video conferencing, and secure digital identification methods to verify the identities of the parties involved. The notary public oversees the process and ensures the proper execution of notarial acts.

The advantages of e-Notary in Estonia include convenience, accessibility, cost-effectiveness, increased security, and improved efficiency. It allows for remote notarization, eliminates the need for physical paperwork, and reduces the time and effort required for notarial processes.

Yes, e-notarized documents are valid and recognized internationally. Estonia has a legal framework in place that ensures the validity and acceptance of digitally notarized documents in various jurisdictions.

The future of e-Notary in Estonia looks promising, with potential advancements in virtual notary services and emerging technologies that could further enhance the efficiency and accessibility of digital notarization.

Individuals and businesses can explore e-Notary opportunities in Estonia by becoming e-residents and accessing the digital services offered by Estonia’s e-residency program. By doing so, they can easily utilize the digital notarization services provided by the Estonian notary system.

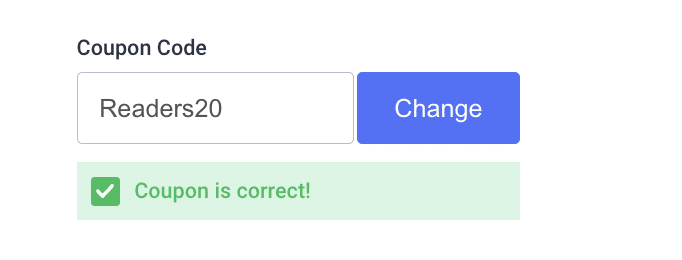

You can purchase a ready made company from Estonia by Notary Public if you meet all KYC& AML recruitments and provide us with notarized and apostilled Power of Attorney.