Annual Report in Estonia

👋 In Estonia, private limited companies (OÜ) have an annual obligation – their Annual Report 📊 Eesti Consulting is here to make this process simple and stress-free for you. 😊 We’re your friendly experts, dedicated to helping you with all your annual report filing needs. 📁 Our team takes care of the paperwork 📝 while you focus on what you do best – growing your business! 🚀 Let’s work together to ensure your compliance and success.

Dormant Annual Report

Sometimes the entrepreneurs did not start a business in Estonia but successfully registered a company. What to do in this case? A lot of clients ask: Do I need to file an Annual Report if I did not achieve any turnover? The answer is: YES. ✅

Here is the table with situations when you can file a Dormant Annual Report:

| Situation |

|---|

| No transactions occurred in the company’s bank or securities accounts 💳 |

| No sales invoices were generated 🧾 |

| No purchase invoices were received 📥 |

| No changes in assets 📈 |

| No changes in liabilities 📉 |

Annual Report for Active Companies

If you made a purchase, if you sold itmes or services , if your bank statement contains any accounting records, you are not allowet to file dormant accounts in Estonia. In this case you have legal obligation to preapre official Annual Report for active companies. Our accountant will ask you for:

| Questions |

|---|

| 1. 📄 Attach a bank statement in PDF or CSV |

| 2. 📋 Attach all issued invoices (Sales) |

| 3. 📋 Attach all issued invoices (Purchases) |

| 4. 📑 Attach missing agreements with counterparties – if needed |

| 5. 💳 Attach all bank statements from payment processors like stripe.com, cryptocurrency exchange, currency exchange systems |

| 6. ❓ Answer questions in relation to your business |

Annual Report approved by e-Residency card

In Estonia, the completion and submission of the Annual Report, which includes the Annual Accounts, are fundamental legal obligations for private limited companies (OÜ). To meet these requirements seamlessly, the Estonian regulatory framework mandates that the Annual Report be signed using the e-Residency card with PIN-2. This digital signature method not only ensures compliance with Estonia’s corporate regulations but also streamlines the submission process. It’s a prime example of how Estonia leverages technology to make the Annual Report filing process efficient and convenient for businesses operating in the country. 📊💼🇪🇪

Annual Report if e-Residency Card Has Expired” 📅🔒

📅 Ensuring the timely submission of your Annual Report is a must in Estonia, and if your e-Residency card has expired, we want to keep things simple and friendly.

📧 Three months before your card’s expiry, you’ll receive a friendly reminder via email from the Estonian Police and Border Guard Board.

💳 Applying for a renewal is a breeze, with the state fee being the same as when you first applied (€100-120).

🌍 In your renewal application, just choose your preferred pickup location from over 40 worldwide options.

🚀 Remember to collect your new card before the old one expires to keep enjoying Estonian e-services smoothly.

File Annual Report? Hire us EESTI CONSULTING! 👋

Annual Report Q&A

An Annual Report in Estonia is like a company’s “year in review.” It shows all the financial info and what the company’s been up to during the year. If you run a company in Estonia, like an OÜ or others, you’ll need to do an Annual Report. Even non-profit groups and foundations have to do it! The deadline is usually six months after the year ends, which is often June 30th if you go by the calendar year. Yes, you can ask for an extension, giving you up to nine months to finish your Annual Report. But there are some rules for that. Contact Eesti Consulting and ask. Absolutely! Estonia loves tech. You can do it online through the Company Registration Portal RIK for an easy-peasy experience. The Annual Report usually has a bunch of things like a management report, balance sheet, income statement, cash flow statement, equity changes, and some notes. Yep, you can choose a different financial year, but there are some rules and limits to keep in mind. For the latest info, check out the Estonian Commercial Code, Estonian Accounting Act, or chat with the pros to stay in the loop! 🇪🇪💼🤝Annual Report in Estonia

How To Define a Person for Annual Report Submission?

Log in to the https://ariregister.rik.ee/eng

Use Your e-residency card

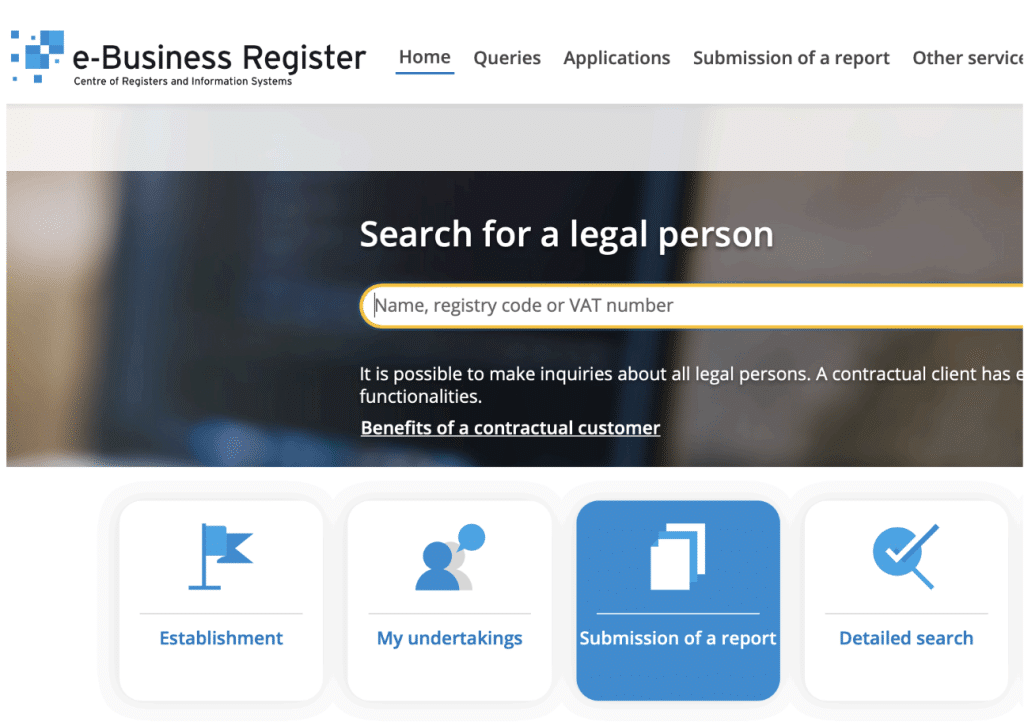

Click a “Submission Report”

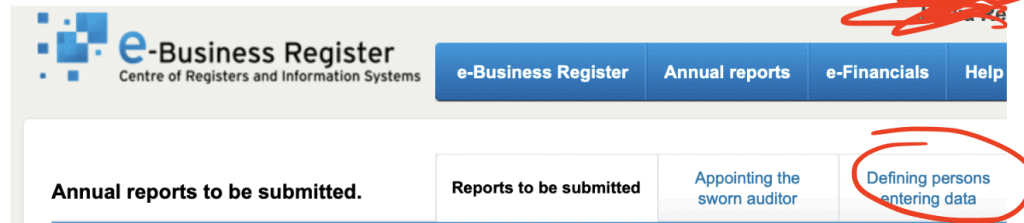

Click on “Defining persons entering data”

The Last Step: Please click “Add new person for entering data”

Annual Report Deadline

📅 Annual Report Deadline in Estonia: The Basics

Hey there! Let’s chat about the deadline for submitting your Annual Report in Estonia. It’s not as complicated as it might sound, so we’ll keep it simple and friendly:

⏰ Filing Deadline: Normally, you’ve got six months after the end of your financial year to get your Annual Report in order and submitted. Most companies in Estonia use the calendar year as their financial year, but you can choose a different one if it suits your business better.

📆 Extension Option: Life can get busy, right? If you need more time, you can request an extension. That can give you up to nine months in total to get your Annual Report sorted. Just remember, there are some conditions for getting that extra time.

⚖️ Late Filing Penalties: Okay, so here’s the thing—missing the deadline could lead to penalties and other not-so-fun consequences. You might have to pay fines, and certain rights could be temporarily suspended until you file that report.

🧐 Financial Watchdog: There’s a friendly authority called the Financial Supervisory Authority (Finantsinspektsioon) in Estonia. They’re the ones who keep an eye on things, making sure companies follow the rules when it comes to accounting and reporting.

💻 E-filing: Estonia loves technology! You can make your life easier by submitting your Annual Report electronically through the Company Registration Portal (Äriregister). It’s a convenient way to get your reporting done.

📝 Stay Updated: Laws can change, so it’s smart to stay informed about any updates regarding deadlines and requirements. Keep an eye on the latest legislation, and if you’re ever unsure, don’t hesitate to seek advice from legal experts or authorities. They’re there to help!

So, there you have it—your friendly guide to Annual Report deadlines in Estonia. Keep it simple, and if you ever need assistance, we’re here to help. 🇪🇪💼📊

Annual Report Example

📋 Annual Report for OÜ Companies in Estonia: Navigating the Requirements

Meet Markus: An entrepreneur running his private limited company (OÜ) in Estonia. Like many business owners, he’s keen to understand the ins and outs of the Annual Report requirements to keep his business compliant and thriving. Let’s take a look at Markus’s journey through this process.

📊 Understanding Full Annual Report Demands

Markus’s OÜ company falls into the medium-sized category, making it essential for him to prepare a full Annual Report. This comprehensive report encompasses various elements, including a management report, four core financial statements (balance sheet, income statement, cash flow statement, and the statement of changes in owners’ equity), and necessary notes.

💼 Options for Micro-Enterprises

Markus also realizes that micro-enterprises like his have an alternative. They can opt for an abridged annual account, akin to that of a small undertaking. However, should they require it, micro and small enterprises can always switch to a full annual report.

📑 Notes to the Annual Accounts: Markus knows that while the number of notes may vary, specific details are a must. These include mentioning the financial reporting standard used, outlining accounting policies, and providing explanations regarding key entries and changes throughout the reporting period.

Markus’s story exemplifies the importance of understanding the Annual Report requirements for OÜ companies in Estonia. With this knowledge, he can keep his business compliant and transparent, ensuring its continued success in the dynamic Estonian business landscape. If you have questions or need assistance like Markus, don’t hesitate to reach out. We’re here to simplify the process and support your business journey! 🇪🇪💼🤝

📄 Language and Currency Considerations

To ensure compliance, Markus ensures that his annual accounts are prepared in Estonian and reflect the official currency of Estonia. He specifies the degree of precision, whether in euros or thousands of euros.

📊 Unpacking the Key Statements

Balance Sheet and Income Statement: Markus understands that the balance sheet showcases his company’s financial health at the end of the financial year, while the income statement provides insights into income, expenses, and profit or loss during the reporting period.

💰 Cash Flow Statement: The cash flow statement reveals the flow of cash within his company throughout the reporting period, categorizing receipts and expenditures into operating activities, investing activities, and financing activities.

📈 Statement of Changes in Equity: Markus recognizes the importance of this statement in tracking changes in his company’s equity over time. It records contributions of capital, disbursements to owners, profit or loss, changes in accounting policies, and other crucial financial transactions.