Subsidiary in Estonia – Register It!

Open Subsidiary in Estonia

A subsidiary company is a business entity that is controlled and owned by another company, known as the parent company. The parent company holds a significant portion of the subsidiary’s voting stock, allowing it to influence and make decisions for the subsidiary.

🇬🇧 A British company will retain 100% ownership in an Estonian company. The British company is the sole shareholder in the Estonian company. 🇪🇪

10 Benefits of a Subsidiary in Estonia

🌍 Access to the European Single Market: Estonia offers easy access to the European Single Market, allowing your business to tap into a vast customer base without hassles.

💰 Low Corporate Taxation: Deffer Corporation Tax – 0% Corporation Tax – See more tax benefits of opening company in Estonia (Regarding Corporate Income Tax (CIT), the relevant rate is set to rise to 22% in 2024)

💼🌱 Tax Exemptions for Reinvested Profits: Estonia encourages long-term investment by exempting corporate income tax on reinvested profits, helping your business grow sustainably.

🤝✅ Ease of Doing Business: Estonia consistently ranks at the top of business-friendly countries, with accolades such as being 1st in the International Tax Competitiveness Index in 2022 and ranking 18th in the Ease of Doing Business Index in 2019.

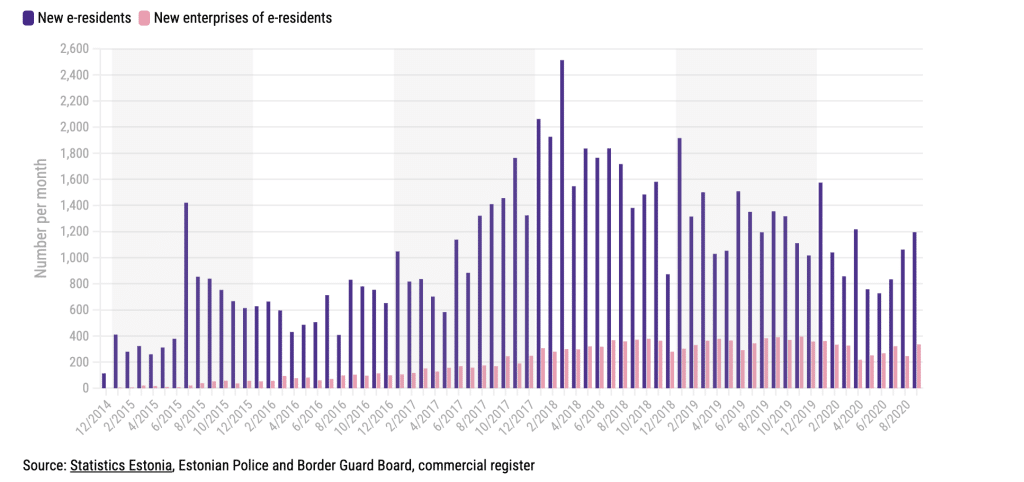

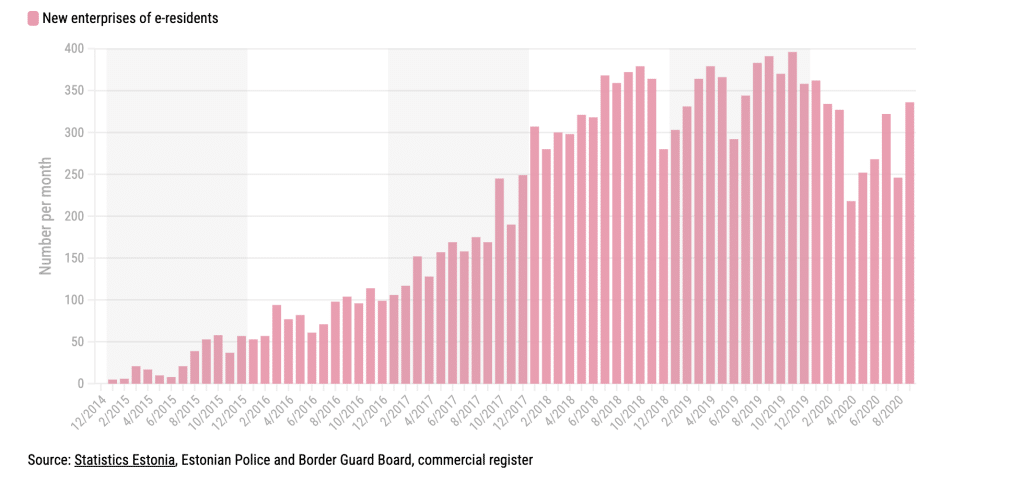

📈🔐 E-Residency Program: Estonia’s E-Residency program is thriving, with over 105,011 e-residents and 27,090 Estonian companies established by e-residents. It’s a fantastic option for remote management of your subsidiary.

💼🎓 Skilled Workforce: Estonia boasts a highly educated and tech-savvy workforce, ready to support your business endeavors. Hire employees through an Estonia recruitment agency, or Upwork.com, directly from Tallinn.

🏛️🤝 Stable Political Environment: Estonia’s stable political climate and commitment to the rule of law ensure a secure and reliable business environment.

📚🔒 Protection of Intellectual Property: Estonia enforces strong intellectual property laws. Our firm, Eesti Consulting, can help you register a trademark in Estonia or the EU for your subsidiary company.

🇪🇺💰 Access to EU Funding: Whether you represent an Estonian company or a foreign one registered in an EU country, you’re eligible for EU funding. But hurry, it’s first come, first served! You can get grants from the EU and reduce state fees by -75%.

🌟🌐 Strategic Location: Estonia’s strategic location in Northern Europe serves as a gateway to markets in Scandinavia and the Baltics, making it a prime choice for expansion.

Registration a subsidiary in Estonia offers numerous benefits, from tax advantages to a supportive business environment, and our Eesti Consulting team is here to assist you every step of the way! 🇪🇪🏢💼

Start Registration Subsidiary in Estonia

Open Branch in Estonia

🌍 Foreign Branch in Estonia 🇪🇪

Imagine your company wants to expand its reach to Estonia! 🛫 But instead of creating a whole new company there, you decide to open a foreign branch. 🏢

This branch in Estonia is like a branch of a tree, attached to your main company trunk. 🌳 It’s part of your company, but it’s located in a different country.

The cool thing is, your Estonian foreign branch operates under your company’s name and follows your company’s rules. It’s like having a friendly outpost in Estonia, ready to do business on your behalf. 👥📈

While it enjoys some independence to adapt to local stuff, like Estonian laws and market trends, it’s still part of your company family. 💼

So, when it comes to profits, losses, and assets, they’re all part of the same pot. 🍲

But be ready for some paperwork! 📝 Your Estonian foreign branch will need to follow Estonian regulations, and there might be some tax considerations to sort out in both your home country and Estonia. 💰📑

It’s a great way to expand your company’s horizons and make friends in Estonia. 🇪🇪🌟 Just remember, it’s a bit like having a distant cousin – related but with its own unique character! 😉

🇪🇪 Branch in Estonia – Key Features Simplified 🏢

So, you’re thinking about opening a branch in Estonia? Great choice! 🌍

Here’s the lowdown in a nutshell:

🚫 No Legal Personality: Your Estonian branch won’t have its own legal personality. It’s like the supporting actor in a movie, important but not the star. 🌟

🔒 Legal Capacity: Your branch won’t have legal capacity either. It’s like the sidekick, there to help but not the decision-maker.

💼 Corporation Tax: Your branch is responsible for paying Corporation Tax only on the profits it earns in Estonia. Think of it as paying your dues in the local scene.

📜 Paperwork: The parent company takes care of the branch’s operation, including paperwork like billing and Annual Accounts (Profit & Loss, Balance Sheet, Trial Balance). It’s a team effort! 🤝

🤝 Estonian Representative: You’ll need an Estonian representative (Authorized contact person). They’ll be your branch’s local connection, kind of like a tour guide in a new city.

🔄 Identical Operations: Make sure your branch’s operations are identical to the parent company. Consistency is the name of the game.

Now, about opening that branch in Estonia, Eesti can lend a helping hand. They’re experts in making this process smooth and hassle-free. 🤗

So, get ready to make your mark in Estonia! 🇪🇪💼

Documentation Required for Establishing a Branch in Estonia 📄🇪🇪

To set up your branch in Estonia, you’ll need to gather these vital documents:

📝 Name and Legal Form of the Parent Company: Tell us all about your parent company’s name and legal structure.

🌍 Country of Registration: Where is your parent company registered? We need to know the country.

📊 Subject of Activity (SIC Codes): Let us know the areas your company will be active in, following the EMTAK classification.

🎯 Purpose of Company Registration: What’s the big goal for your company in Estonia? Share your purpose with us.

🏢 Company Address: Provide the address where your branch will operate in Estonia. (Eesti offers company address in Estonia)

👥 List of Actual Beneficiaries: Tell us who owns shares in your company. We’re curious about the stakeholders.

👩💼 List of Board Members: Who’s steering the ship? Share the names of your board members.

📜 Articles of Association: Share the document that outlines your company’s internal rules and operations.

🗂️ Memorandum of Association: This document tells us about the relationship between your company and its members or shareholders.

📄 Registration Certificate: Proof that your company is legally registered elsewhere. We’ll need to see it.

Gather these papers, and we’ll help you get your branch up and running in Estonia! 🇪🇪💼

Payment of a share capital

📈 No More €2,500 Minimum Capital: We’re waving goodbye to the old rule that said you must have at least €2,500 in share capital to start an OÜ (private limited company) in Estonia. Say hello to more choices! 💰

💡 Capital Tailored to Your Needs: Now, you get to decide how much capital your business truly requires. It’s like a menu of options, and you’re in charge of picking what suits your business best. 🍽️

📜 A Change Long Overdue: The old rule, in place since 1995, didn’t always make sense. Many business owners automatically set their capital at the minimum, whether they needed it or not. 🤷♂️

🤝 More Responsibility, More Efficiency: With this new regulation, you’ll be responsible for determining the right amount of share capital. It’s a step towards smarter, more efficient business formation in Estonia. 💼🔍

📅 Effective from February 1, 2023: Mark your calendars! These exciting changes to the Estonian Commercial Code come into play on 1st February 2023. Don’t miss out! 🗓️

Easily Register Your Branch with a Power of Attorney! 🖋️

Hey there, future branch owner! We’ve got a hassle-free solution for you to register your branch in Estonia. 🏢🇪🇪

📜 Power of Attorney (POA) Registration: We’re here to make things simple. We offer branch registration based on a power of attorney (POA) with a notary public in Estonia.

👩⚖️ Notary-Powered: There are about 30 notaries in Tallinn, and they all have tight schedules. But no worries! We’ll set up a meeting with a notary on your behalf.

🚀 Your Convenient Option: You have choices! You can either come to Estonia, and we’ll assist you with the registration process, or we can handle everything remotely using a power of attorney. We’ll even provide you with a power of attorney template.

✍️ Acting on Your Behalf: We’ve got your back! Eesti Consulting will act as your attorney, making sure everything goes smoothly.

📜🔐 Notary and Apostille: We’ll take care of all the notary and Apostille requirements, so you don’t have to worry about a thing.

🚀 Subsidiary Information Requirements Made Easy! 📋🇪🇪

Hey there, future business owner! 🌟 Getting your subsidiary registered in Estonia is a breeze when you know what we need. It’s all straightforward and friendly. 😊

📝 Here’s the Scoop: For your subsidiary registration, we’ll need some basic info:

-

- 📚 Name and surname of directors

- 🌍 Passport or EEA card number

- 🎂 Date of birth

- 🏡 Full residential address

- 🌐 Country of residence

- 📞 Phone number

- ✉️ Email address

- 💻 Website URL

- 🏢 Company name

- 💼 Nature of business

- 💰 Capital (minimum 2500 EUR)

- 👥 Beneficial owners list