TIN Number or Registry Number or Personal Code – What?

TIN Number

In the context of Estonia 🇪🇪, a TIN (Taxpayer Identification Number) is a unique identifier assigned to individuals or entities for tax purposes. It is used by the Estonian Tax and Customs Board (ETCB) to track and manage tax obligations. The TIN is required for activities such as filing tax returns, making payments, and dealing with any other tax-related matters. In Estonia, the TIN is typically the personal identification code for individuals or a unique business registration number for companies.

Does TIN number exist in Estonia?

In Estonia, there isn’t a traditional TIN as you might find in other countries. Instead, businesses and individuals use different identifiers for various purposes.

Registry Code instead of TIN Number

For companies, the essential identifier is the 8-digit company registration code. This code is assigned to every registered business and serves as the primary means of identification across all institutions and services in Estonia.

For individuals, the equivalent is the 11-digit personal identity code, or isikukood. This number uniquely identifies individuals and is used extensively in both personal and professional contexts.

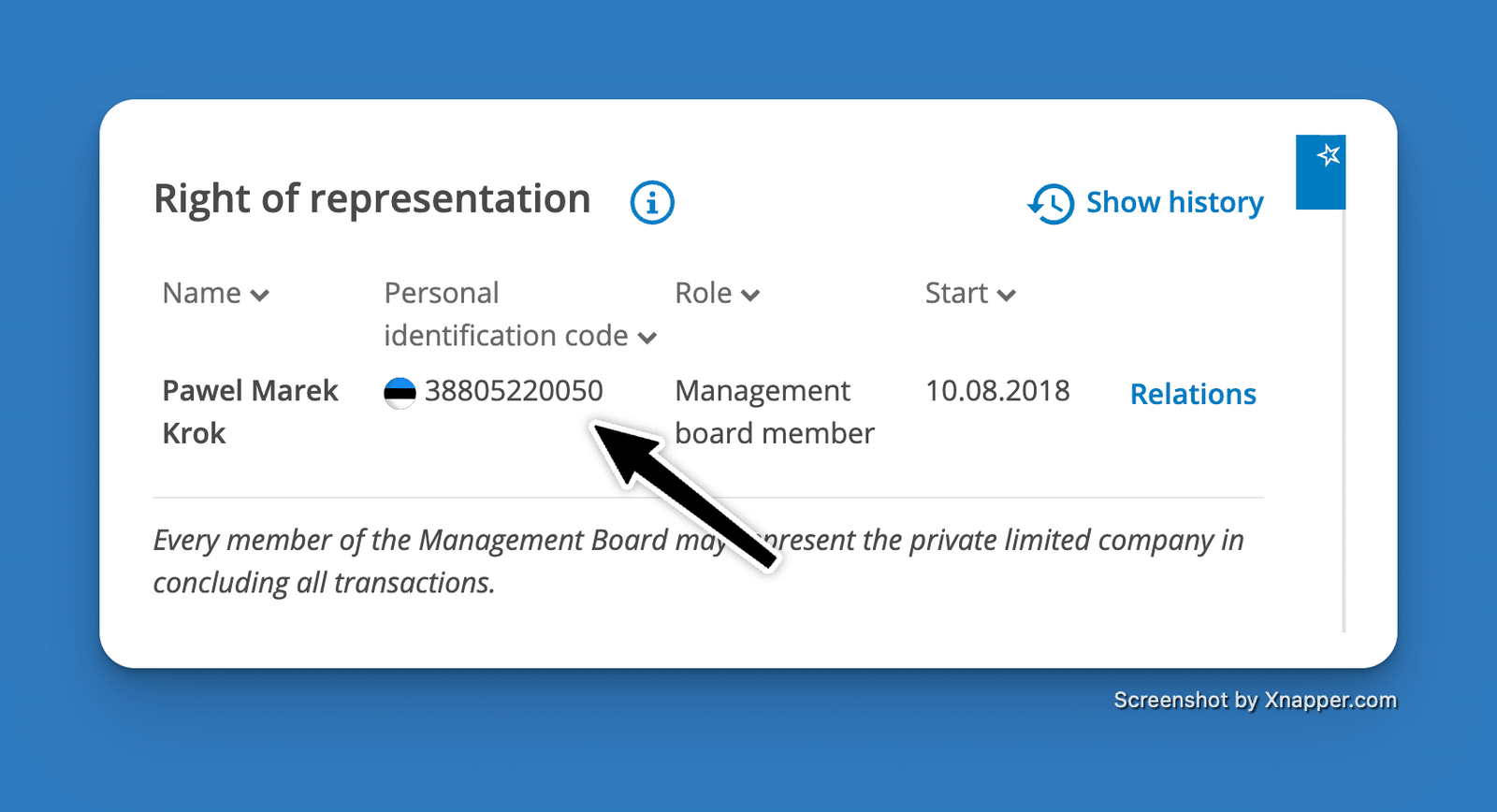

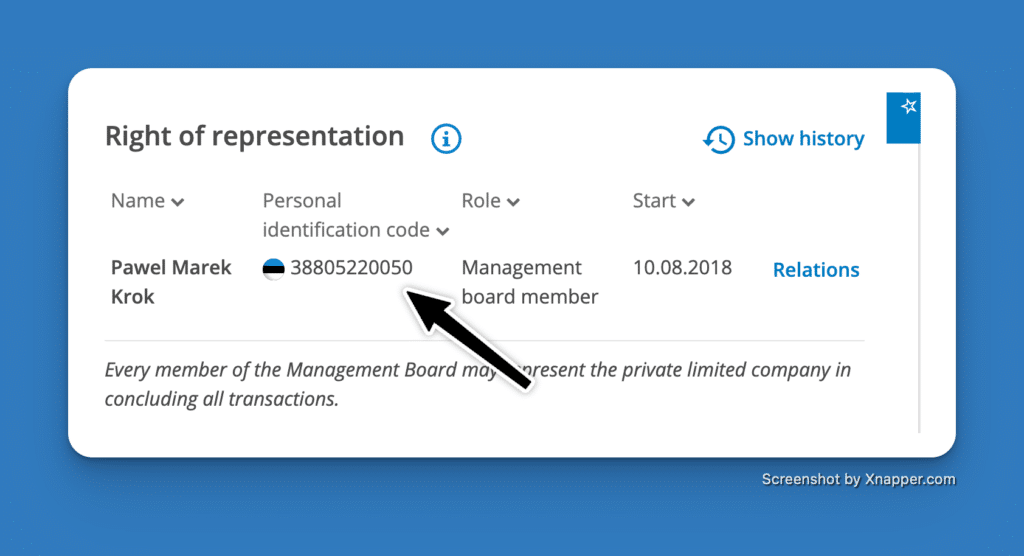

Personal Indetification Code or Personal Number of Board Member

If you are requested to present a unique taxpayer number (sometimes called a TIN) somewhere outside Estonia, the company registration code is typically the number you should provide. Similarly, if you are asked for a VAT registration number, note that in Estonia, it is not mandatory to have one unless your company exceeds certain revenue thresholds.

Who Can Ask You For TIN Number?

A TIN number, or its equivalent, is often required by banks (WISE, Revolut, Paysera, Payoneer) or other foreign institutions to identify your company accurately. This number helps streamline various processes such as opening bank accounts, applying for loans, and complying with international tax regulations.

Sometimes you can be asked for a TIN Number by EUIPO when you register a trademark and apply for an SME FUND 2024 Grant. In the application, they ask about your Tax Identification Number. So, if there is no Tax Identification Number in Estonia, you can simply enter the Registry Code if your company trades below the VAT threshold or enter the VAT Registration Number.

Order Original Corporate Documents with TIN Number

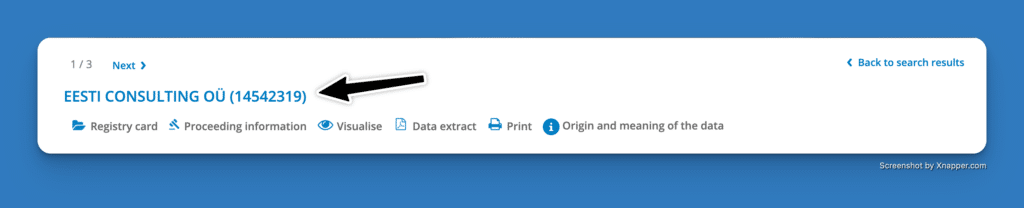

As you know, you can visit the Commercial Register website to verify a company registered in Estonia by typing its Registry Code or name.

If you wish to obtain an original package of documents confirmed by a notary stamp or with an Apostille, just contact Eesti Consulting and request this service.

How To Verify TIN Number in Estonia?

#Approach 1: Use the Estonian Tax and Customs Board (ETCB) Portal

The ETCB provides an official online service to check the validity of a TIN.

Steps:

Go to the ETCB website: https://www.emta.ee

Navigate to the “e-Services” section.

Choose the “Check TIN” or similar option.

Enter the TIN number you wish to verify.

The system will confirm if the TIN is valid or not, and provide any additional details if available.

#Approach 2:

Verify Through the Business Register

You can verify a TIN for companies through the Estonian Business Register.

Steps:

Visit the Estonian Business Register: https://ettevotjaportaal.rik.ee

Search for the company using the TIN or company name.

The search will return details about the company, including its TIN, registration status, and other key information.

#Approach 3:

Request Confirmation from the Individual or Business

If you need to verify a TIN in a more direct way, you can request the taxpayer to provide official documentation that includes their TIN. This could include:

- Tax Returns: Personal or business tax documents that display the TIN.

- VAT Registration Certificate: If the entity is registered for VAT, their VAT certificate will show the TIN.

#Approach 4:

Check Through EU VAT Information Exchange System (VIES)

If the TIN is for a business entity in Estonia that is VAT-registered, you can use the VIES system to check the VAT number, which acts as the TIN for VAT purposes.

Steps:

Visit the VIES website: https://ec.europa.eu/taxation_customs/vies/

Select Estonia as the country.

Enter the VAT number (TIN) and press “Verify.”

You’ll receive confirmation on whether the VAT number (TIN) is valid or not.

#Approach 5:

Contact the Estonian Tax Authority Directly

If other methods fail or if you need more detailed information, you can contact the Estonian Tax and Customs Board directly for verification.

Contact Information:

Phone: +372 880 0811

Email: info@emta.ee

You can inquire whether a specific TIN is registered and valid, but keep in mind that personal or business privacy regulations may limit the details available.

Conclusion

In Estonia 🇪🇪, the Taxpayer Identification Number (TIN) is a crucial tool for managing tax obligations, both for individuals and businesses. It serves as a unique identifier, ensuring that tax authorities can accurately track and manage tax affairs. Whether you’re verifying a TIN for personal or business purposes, Estonia offers various ways to confirm its validity, including using the Estonian Tax and Customs Board (ETCB) portal, the Business Register, or the EU VAT Information Exchange System (VIES). Always ensure that the TIN is valid and correctly registered to avoid any issues with compliance or tax reporting.