Open Holding Company in Estonia 🇪🇪

🚀 We assist you in opening a Holding Company in Estonia. If you don’t want to run a solo company in Estonia, where you would keep 100% shares as a natural person, we can help. You might prefer your home country’s company (e.g., LTD) to be the 100% shareholder in the Estonian company. This creates a tax-efficient structure known as a holding company. We can also help with opening a company in Estonia from scratch, opening a branch, opening a subsidiary, and selling ready-made companies with active VAT registration Start your holding Company with Eesti Consulting

What is the Holding Company and Its Purpose?

Holding company is like a money manager for various things, such as property, stocks, or other companies. It’s set up to keep the money and risks separate for the owners. This way, if one of the things it owns has money troubles, the owners are less at risk. Big holding companies make money in two main ways:

From What They Own: They get money from the companies they own, either by getting a cut of the profits those companies make or by selling a piece of those companies for more money.

Making Things Easier for Everyone: Holding companies can make extra money by making things more efficient. For example, if they own a few companies, they might provide services like IT or human resources to all of them. This helps everyone save money and makes the holding company more money.

Disadvantages of holding company in Estonia

You can’t create holding company with e-Residency Card

The E-Residency Card is linked to an individual, a natural person, and is tied to their personal signature. However, a holding company is a legal entity where another legal entity, not an individual, holds 100% of the shares in an Estonian company.

This is not the cheapest option.

| Type of Company | Registration Cost | Shareholder |

|---|---|---|

| Individuals (E-Resident) | 499€ | 100% shares – Natural Person |

| Holding Companies (Notary) | 2000€ | 100% shares – Legal Person |

the notary public is engaged in this proccess

The notary public is engaged in this process. We require a notarized and apostilled Power of Attorney from a foreign company (e.g., 🇩🇪 GmbH or 🇬🇧 British LTD). Acting in front of the notary, we proceed to purchase shares on behalf of the foreign company. The foreign company becomes a 100% shareholder in the Estonian company (🌐).

Advantages of Holding Companies in Estonia

Traveling in tallin is not requred

We handle all tasks entirely remotely. To proceed, we require a notarized Power of Attorney document from you, along with an apostille and a certified translation. Using these documents, we can either establish a new company on your behalf or offer you an already established company for purchase. More about share transfer in Estonia.

Corporation tax – 0% – deffer corporation tax

Estonia’s corporate tax system operates uniquely under a territorial principle, where companies are taxed solely on distributed profits, encouraging reinvestment and growth. The standard corporate tax rate is 20%. However, starting in 2025, there’s a planned increase in income tax for both corporations and individuals, going from 20% to 22%. Notably, the preferential corporate tax rate of 14%, specifically for regularly distributed profits, and the associated 7% withholding tax on dividends to natural persons will be phased out.

N.B For Holding Companies, the retention and reinvestment of profits continue to be exempt from corporate income tax.

E-Residency card and e-residency marketplace

Enjoy the convenience of managing your company with the E-Residency Card! Apply today to streamline tasks such as signing documents digitally, checking document authenticity, securely sending files, accessing various online services, starting an Estonian company online, and managing it from anywhere globally. Benefit from digital banking, handle online payments effortlessly, and file corporate taxes conveniently if your company is a tax resident in Estonia. Read more about benefits of opening company in Estonia.

We ensure that all Estonian companies within holding structures have valid VAT Registration (VAT EE number). Our guarantee extends to Estonian shelf companies, ensuring they are in excellent standing with no civil or tax liabilities. Upon your request, we also provide a Certificate of Tax Clearance, VAT Certificate and Certificate of Tax Residency as well.

Example of a Holding Company

| Idea for Using Holding Companies | Description |

|---|---|

| International Expansion | 🌐 Facilitate expansion into global markets, holding subsidiaries in different countries. |

| Asset Protection | 🔒 Safeguard assets by separating them within a holding structure, reducing legal and financial risks. |

| Tax Optimization | 💶 Leverage favorable tax environments by strategically placing assets and subsidiaries. |

| Merger and Acquisitions | 🔄 Streamline the process of acquiring or merging with other companies for business growth. |

| Estate Planning | 🏰 Efficiently pass on assets and wealth to heirs while maintaining control through a holding company. |

| Real Estate Investments | 🏡 Hold and manage real estate properties, optimizing returns and minimizing taxation. |

| Intellectual Property Management | 🛡️ Centralize control over patents, trademarks, and copyrights for effective IP portfolio management. |

| Joint Ventures | 🤝 Facilitate partnerships and joint ventures, providing a structured framework for collaboration. |

| Financial Portfolio Management | 💼 Manage diverse investments, including stocks, bonds, and other financial instruments. |

| Succession Planning | 🔄 Plan for business continuity by structuring ownership and management succession. |

LEI number for Estonian Company

What is LEI number?

A Legal Entity Identifier (LEI) is an internationally recognized and endorsed identification code, backed by the G20, that uniquely identifies entities involved in financial transactions. Each LEI contains essential information about a company, including its identity and organizational structure. The adoption of LEIs is gaining momentum worldwide, positioning it as a crucial identifier within the global financial landscape. Its widespread use brings about significant advantages, enhancing transparency in capital markets, as well as facilitating processes such as banking operations, Know Your Customer (KYC) procedures, client onboarding, and anti-money laundering efforts. It’s worth noting that Estonian companies are eligible to obtain an LEI number, enabling them to participate in global financial transactions while adhering to regulatory requirements and benefiting from the associated advantages.

How to Apply for LEI Number in few steps?

Apply for LEI number here.

| Step | Description | Time Required |

|---|---|---|

| 1. Fill out registration form | Complete the registration form on the website. | Approximately 5 minutes |

| 2. Make payment | Process the payment for your LEI application. | Approximately 3 minutes |

| 3. Wait for LEI issuance | Allow time for your LEI to be processed and issued. | Dependent on LEI issuance timeframes |

| 4. Receive LEI | Once issued, your LEI will be uploaded to the global index and sent to you via email. | Dependent on LEI issuance timeframes |

| 5. Renewal reminder | Keep in mind that LEIs require annual renewal. | Ongoing |

We Have Clients from European Countries

🇩🇪 Germany: GMBH – 100% shares in Estonian OU

🇵🇱 Poland: Sp. z o.o – 100% shares in Estonian OU

🇫🇷 France: S.a.r.l – 100% shares in Estonian OU

🇬🇷 Greece: EPE – 100% shares in Estonian OU

🇮🇹 Italy: S.r.l – 100% shares in Estonian OU

🇪🇸 Spain: S.L. – 100% shares in Estonian OU

🇳🇱 Netherlands: B.V. – 100% shares in Estonian OU

🇧🇪 Belgium: NV/SA – 100% shares in Estonian OU

🇵🇹 Portugal: LDA – 100% shares in Estonian OU

🇸🇪 Sweden: AB – 100% shares in Estonian OU

🇩🇰 Denmark: A/S – 100% shares in Estonian OU

🇦🇹 Austria: GmbH – 100% shares in Estonian OU

🇫🇮 Finland: OY – 100% shares in Estonian OU

🇮🇪 Ireland: LTD – 100% shares in Estonian OU

🇨🇿 Czech Republic: S.R.O. – 100% shares in Estonian OU

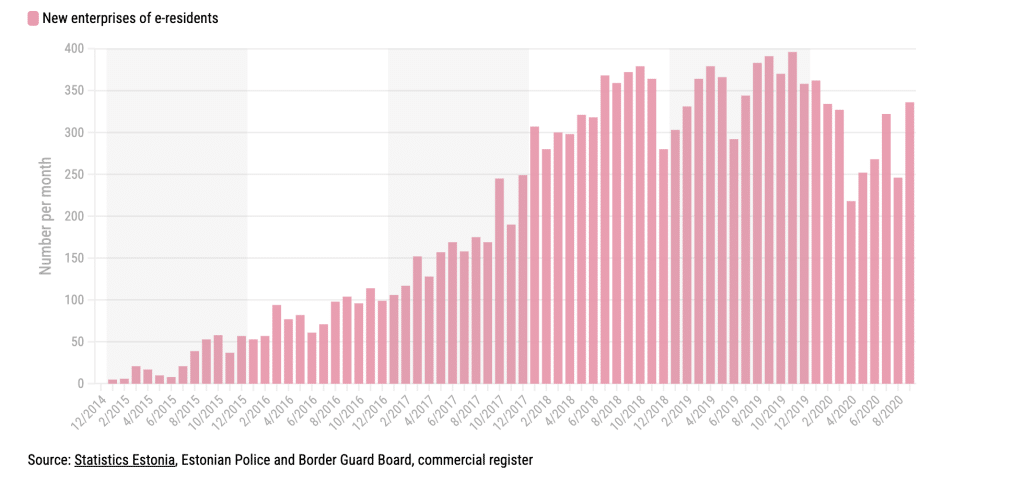

Companies founded by e-Residents between 2014-2020

Useful Links

| Name | Link |

|---|---|

| Holding Company Explanation | Wikipedia – Holding Company |

| What is the holding company and how to use it? | Wolters Kluwer – Expert Insights |

| Estonian Tax & Customs Board | Estonian Tax & Customs Board |

| Estonian Chamber of Commerce and Industry | Estonian Chamber of Commerce and Industry |

Register Holding Company in Estonia 🇪🇪

Set Up Holding in Tallinn!

Personal visit in Tallinn is required. The transaction is conducted in the notary public office.

Set up HOLDING remotely!

We always need a certified / notarized and apostilled Power of Attorney issued in your living country to proceed with the transaction.

Buy Ready Made Company

The remote transfer of shares in Estonian company is still possible once we get Power of Attorney from you . Take over existing company and change a business name and nature of business! It works well!

Questions taken by our custommers

🇪🇪🇪🇺🇬🇧 Cost of Holding Company in ESTONIA

🇪🇪 Cost of Registration HOLDING company

€ 2000

Holding Company Registration from scratch (Notary Public)

- Company Registered under the laws of Estonia, ensuring compliance with local regulations

- The state fee 260EUR included in the purchase price

- Ready for immediate use, saving you time and effort

- Notarial fees and certified translations are not included

- No civil or tax liabilities, giving you peace of mind

🇪🇪 Cost of Ready Made Holding Company

€ 2500

Ready made VAT company – already VAT registered / EORI application – free of charge on demand

- VAT registered shelf company from Estonia ( VAT EE number on VIES is valid)

- Drafting of Power of Attorney included

- Notarial and solicitor fees are included

- State fee – 260 EUR is paid

- Share capital not paid

- Certified translation fees not included

🏦 Holding Company needs a Bank Account – WHERE?

Worth it for seamless global finances: Borderless Banking, low fees, real exchange rates, multi-currency support in 80+ countries, and convenient local bank details. 🌐💸💳🌍🏦

🌐 Borderless Banking

💸 Low Fees, Real Rates

💳 Multi-Currency (USD, GBP, EUR)

🌍 80+ Countries

🏦 Local Bank Details

Unlock your Business Potential with Payoneer account

🏦 10+ Currency Accounts in 1 Day

💼 Global Swift WIRE (USD/Euro/GBP)

💰 Payments from 200+ Countries

🌐 Receive from 2000+ Marketplaces

💳 Pay Worldwide: 200+ Countries

💳 Multi-currency MasterCard

💲 Competitive FX Fees

More than 200,000 clients are using banking services. Bank has the strongest investment and entrepreneurship experience.

Open bank account at LHV

- Monthly maintenance fee – 0 €

- Free of charge up to 50 SEPA payments

- Debit card from 2€

- Accepting card payments and payments in online stores

- Payments via bank link