7 Easy Steps to Register a Business in Europe [2023] – Estonian Choice

Are you an entrepreneur with big dreams of expanding your business internationally? Starting a company online in the EU opens up a world of opportunities for growth and success.

From the bustling startup scenes to established markets, Europe offers a diverse range of possibilities for entrepreneurs. But before you embark on this exciting journey, it’s crucial to understand the challenges involved. Thorough research and careful planning are essential to ensure your new company thrives in the European market.

Join us as we delve into key considerations such as choosing a suitable business structure, navigating legal requirements, and leveraging virtual offices to establish your presence. Get ready to unlock the potential of Europe and take your business to new heights!

🌍 Benefits of Registering a Business in Europe

Starting a business in Europe comes with a multitude of benefits that can give your company a competitive edge. Let’s dive into the advantages of registering a business in Europe and why it might be the right move for you.

📈 Access to a large consumer market

One of the biggest perks of starting an EU company online is gaining access to a massive consumer market. With over 500 million potential customers, Europe offers vast opportunities for businesses to expand their reach and increase their customer base. This means more potential sales and revenue for your business.

💼 Favorable tax regimes and incentives

European countries often offer favorable tax regimes and incentives to attract businesses. These can include reduced corporate tax rates, exemptions, or deductions that can significantly lower your tax obligations. By taking advantage of these incentives, you can save money on taxes and allocate those funds towards growing your business.

🌐 Enhanced credibility and reputation

Having a European presence can enhance the credibility and reputation of your business. The

Opportunities for cross-border trade

Registering a business in Europe opens up opportunities for cross-border trade within the EU’s single market. The EU has created an environment where goods, services, capital, and labor can flow freely between member states. This allows businesses to easily expand their operations across borders without facing excessive barriers or restrictions.

Access to skilled labor and supportive ecosystems

Europe boasts highly skilled labor pools across various industries. By establishing your business in Europe, you gain access to this talent pool, enabling you to recruit top-notch professionals who can contribute to the growth and success of your company. Many European countries have vibrant innovation hubs and supportive business ecosystems that foster entrepreneurship and provide resources for startups to thrive.

Choosing the Best European Country for Your Business – Estonia

Estonia’s Favorable Business Environment and Digital Infrastructure

Estonia, a small country located in Northern Europe, has gained a reputation as an ideal destination for starting a business. One of the key reasons behind this is its favorable business environment and advanced digital infrastructure. The Estonian government has worked diligently to create an ecosystem that supports entrepreneurship and innovation.

One of the standout features of Estonia is its robust digital infrastructure. The country has invested heavily in technology, making it one of the most digitally advanced nations in the world. This digitalization translates into several benefits for businesses operating in Estonia. For instance, online services such as e-government platforms and digital signatures streamline administrative processes, saving both time and effort.

E-Residency Program Offering Remote Access to Manage Your Estonian Company Online

Another factor that sets Estonia apart. This unique initiative allows individuals from around the world to become “e-residents” of Estonia, granting them remote access to manage their Estonian company online.

Through the e-residency program, entrepreneurs can establish and operate their businesses entirely online, without ever needing to physically be present in Estonia. This level of flexibility opens up countless opportunities for individuals who want to start a European company but don’t necessarily want or need to relocate.

Competitive Corporate Tax Rates Compared to Other European Countries – 0% or 20%?

When considering where to start your European business, corporate tax rates play a crucial role. In this regard, Estonia offers an attractive proposition with its competitive corporate tax rate of 20%. Compared to other European countries where tax rates can be significantly higher, this makes Estonia an appealing choice for entrepreneurs looking to optimize their tax liabilities.

Moreover, Estonia goes a step further to provide an even more enticing tax advantage for entrepreneurs. Through its unique tax system, entrepreneurs may find themselves feeling like they are paying effectively 0% Corporation Tax. This innovative approach involves the taxation of profits only when they are distributed as dividends. As a result, businesses can reinvest their profits for growth and development without immediate tax obligations.

The lower corporate tax rate in Estonia not only allows businesses to retain more of their profits but also provides the flexibility for entrepreneurs to strategically manage their tax exposure. This favorable tax environment helps foster economic growth and encourages foreign investment, further enhancing Estonia’s reputation as a business-friendly country.

Comparision UK taxation system with Estonia

🇬🇧 UK (After Tax-Year Ending) |

🇪🇪 Estonia (Tax-Deferring System) | |

|---|---|---|

| Corporate Tax Rate | Varies (Standard rate: 19%) | 20% (Deferred until distribution) |

| Tax on Dividends | Yes, at applicable rates | Deferred until distribution |

| Tax on Reinvestment | Yes, at corporate tax rate | No immediate tax on reinvestment |

| Tax Planning | Potential complexities | Simplified tax-deferring system |

| Overall Flexibility | Moderate | High |

| Total Tax Paid | Depends on profits, dividends, and reinvestment | Deferred until distribution |

| Profit Distribution | NO | NO |

| Amount | 100,000 EUR | 100,000 EUR (Tax deferred) |

| Total Tax Paid (End of Year) | 19,000 EUR | 0 EUR (Tax deferred) |

| Time for Certificate of Tax Residency | 3-5 months | 2 days |

| e-Notary | No | Yes |

| e-Residency | No | Yes |

| VAT Threshold | £85,000 | €40,000 |

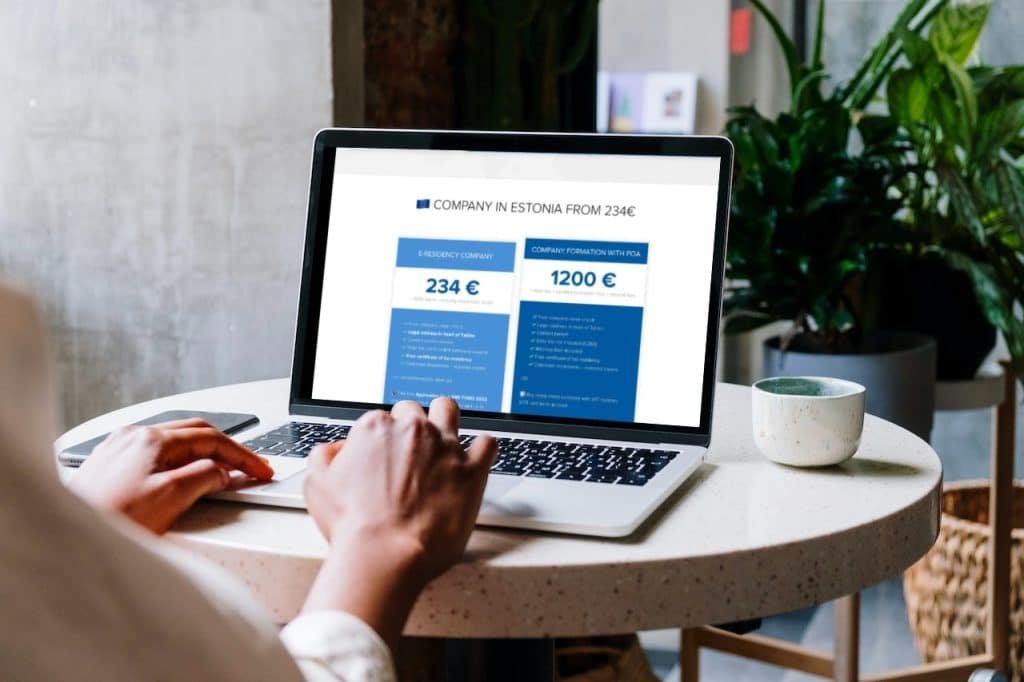

Simple Registration Process with Minimal Bureaucracy and Low Costs Involved

Starting a business in some countries can be a daunting process, often burdened with excessive bureaucracy and high costs. However, Estonia stands out for its straightforward registration process that minimizes red tape and keeps costs relatively low.

The Estonian government has implemented digital solutions to simplify the company registration process. Entrepreneurs can complete the necessary paperwork online, eliminating the need for time-consuming visits to government offices. This streamlined approach not only saves valuable time but also reduces administrative expenses associated with starting a new business.

Estonia’s Reputation as an Innovative Tech Hub Attracting Startups and Digital Businesses

In recent years, Estonia has garnered acclaim as a dynamic tech hub, drawing in startups and digital enterprises from across the globe. The nation’s proactive stance toward embracing technology has cultivated an atmosphere conducive to fostering innovation and entrepreneurship.

Estonia’s unwavering commitment to technological advancements has given rise to triumphant startups like TransferWise (now Wise) and Bolt (formerly Taxify). These success stories have firmly established Estonia as a sought-after destination for ambitious entrepreneurs looking to immerse themselves in a thriving tech ecosystem.

Furthermore, opting to establish a company in Estonia unlocks a plethora of opportunities for funding, grants, and expansion. The country holds a special affinity for ambitious entrepreneurs, reflected in the numerous opportunities and resources tailored to support e-resident businesses. Estonia’s nurturing ecosystem plays a pivotal role in fostering the growth and evolution of startups, making it an appealing choice for those in pursuit of innovation and the means to drive their business aspirations forward.

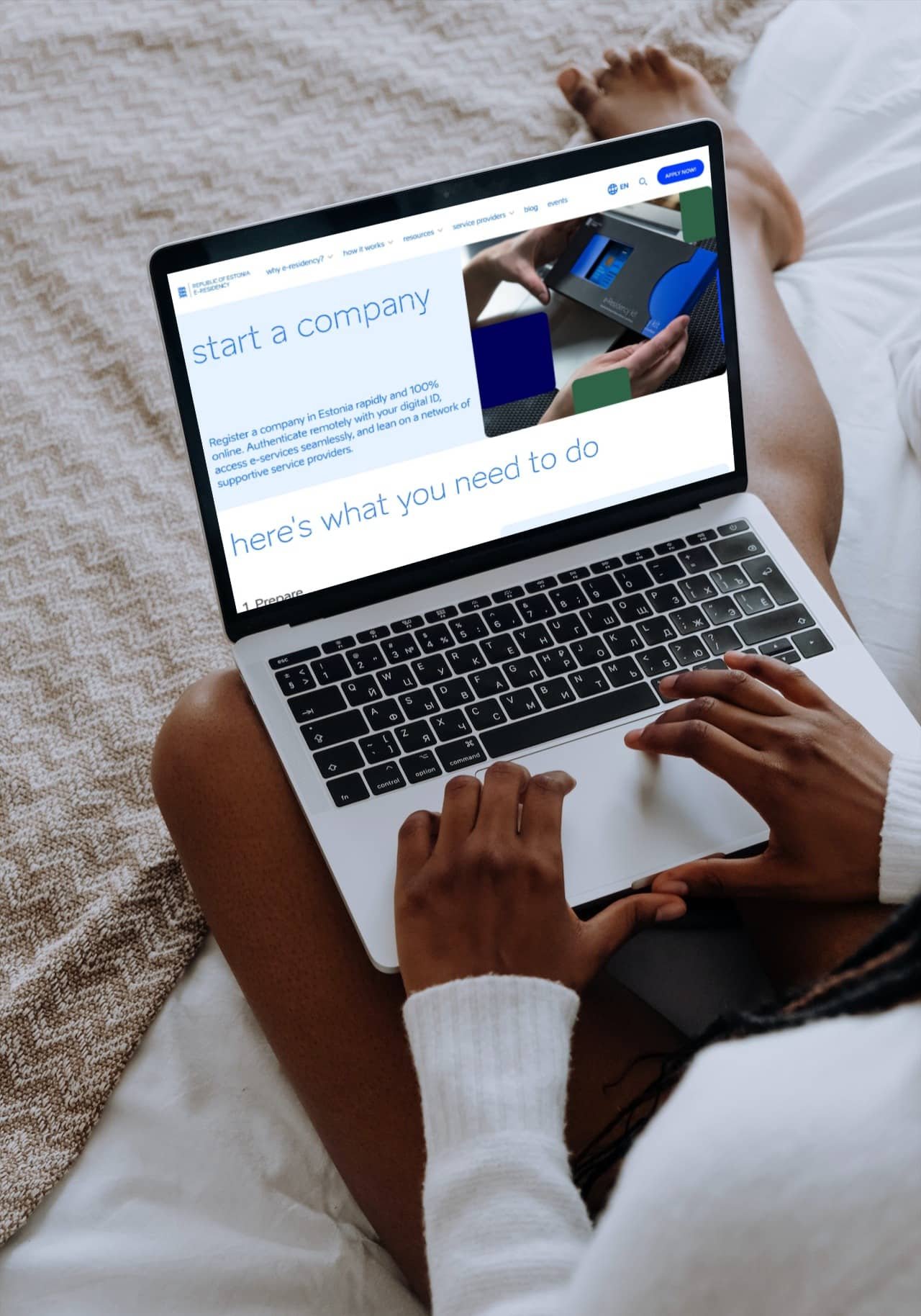

Apply for e-Resideny Card in Estonia

To start a company in Europe, particularly in Estonia, you can apply for an e-Residency card. This digital ID card grants you secure access to Estonian government services online and enables you to electronically sign documents remotely.

E-residency card granting secure access to Estonian government services online

The e-Residency card is a game-changer. With this card, you can access various Estonian government services securely online. You no longer need to physically be present in Estonia to interact with the government or handle administrative tasks related to your company.

Digital identification enabling electronic signing of documents remotely

One of the significant advantages of obtaining an e-Residency card is that it provides you with a digital identity. This digital ID allows you to electronically sign documents remotely, ensuring convenience and efficiency in managing your business affairs. Whether it’s signing contracts, agreements, or other legal documents, the e-Residency card simplifies the entire process.

Benefits of e-residency for managing an Estonian company from anywhere globally

The benefits of e-residency extend beyond just accessing government services and digitally signing documents. It offers flexibility and ease in running your Estonian company from anywhere globally. Here are some key advantages:

-

-

- Location Independence: With an e-Residency card, you have the freedom to operate your business from any location worldwide without being tied down by physical boundaries.

-

- Efficient Business Management: The ability to manage your Estonian company online streamlines processes and reduces administrative burdens.

-

- Access to Financial Services: E-residents can open bank accounts remotely and enjoy various financial services offered by Estonian banks.

-

- Business Expansion Opportunities: Having an Estonian company opens doors for expansion into European markets and facilitates international trade.

- Digital Infrastructure: Estonia boasts a robust digital infrastructure, ensuring a seamless online experience for businesses.

-

Straightforward application process via official website

Getting an e-Residency card in Estonia is a relatively straightforward process. You can apply for it through the official website of the Estonian government. Here’s how:

-

-

- Visit the Official Website: Go to the official e-Residency website and click on the “Apply” button.

-

- Fill in Personal Information: Provide your personal details, including your name, address, and contact information.

-

- Pay the Fee: Pay the required fee using a valid payment method.

-

- Choose Pickup Location: Select the location where you want to collect your e-Residency card once it’s ready.

-

- Wait for Processing: Your application will be reviewed by Estonian authorities, and once approved, you’ll receive an email notification.

- Collect Your Card: Visit the chosen pickup location with your passport or ID document to collect your e-Residency card.

-

Costs associated with obtaining an e-residency card in Estonia

While there are numerous benefits to acquiring an e-Residency card, it’s essential to consider the costs involved. Here’s a breakdown of some expenses:

-

-

- Application Fee: You can choose to pick up your e-Residency card in Estonia at either the Police and Border Guard Board’s Service Point, where the state fee is 100 €, or at the Estonian embassy, where the total state fee is 120 €. This includes 100 € for the application and 20 € for the courier, and you pay this amount when you submit your application

-

Opening a Bank Account for Your Estonian Company

Overview of Banking Options

Now that you’ve obtained your e-Residency card and established your Estonian company, the next step is to open a bank account. Estonia offers a range of banking options for businesses, including both traditional banks and digital banking services provided by fintech companies. These options provide flexibility and convenience for managing your company’s finances.

Requirements and Documentation

To open a business bank account in Estonia, you’ll need to fulfill certain requirements and provide specific documentation. The exact requirements may vary depending on the bank or financial institution you choose, but here are some common prerequisites:

-

-

- Company Registration: You must have successfully registered your Estonian company with the authorities.

-

- Company Address: You will need to provide proof of your company’s registered address in Estonia.

-

- Share Capital: Some banks may require evidence of the share capital that has been paid into your company.

- Contact Person: Many banks will ask for details regarding the contact person responsible for managing the account.

-

In addition to these requirements, you’ll need to submit identification documents such as passports or ID cards for all shareholders, directors, and authorized signatories associated with the company.

Benefits of Digital Banking Services

Estonia is known for its advanced digital infrastructure, which extends to its banking sector as well. One significant advantage of opening a business bank account in Estonia is access to convenient digital banking services offered by local banks. Here are some benefits:

-

-

- Efficiency: Digital banking allows you to manage your finances online from anywhere in the world at any time.

-

- Cost Savings: Many digital banking services have lower fees compared to traditional banks, helping you save money on transaction costs.

-

- Ease of Use: User-friendly interfaces make it simple and intuitive to navigate through various banking functions.

- Integration with Business Tools: Some digital banks offer integrations with accounting software and other business tools, streamlining your financial management processes.

-

Transferring Funds and Making International Transactions

Once you have opened a bank account for your Estonian company, you can begin transferring funds and making international transactions. Estonian banks provide various payment methods to facilitate these processes, including SEPA transfers (for European Union countries), SWIFT transfers (for international transactions), and local payment systems such as the Estonian Instant Payment System.

To make international transactions, you’ll need to provide the necessary details of the recipient’s bank account, including their IBAN number. It is important to ensure that you accurately input this information to avoid any delays or errors in processing your transactions.

List of banks avaiable for e-Residents

WISE Bank Account |

Payoneer | LHV | |

|---|---|---|---|

| Advantages | – Seamless global finances | – 10+ Currency Accounts in 1 Day | – More than 200,000 clients |

| – Borderless Banking | – Global Swift WIRE (USD/Euro/GBP) | – Strong investment and entrepreneurship experience | |

| – Low fees, real exchange rates | – Payments from 200+ Countries | – Monthly maintenance fee – 0 € | |

| – Multi-currency support in 80+ countries | – Receive from 2000+ Marketplaces | – Free of charge up to 50 SEPA payments | |

| – Convenient local bank details | – Pay Worldwide: 200+ Countries | – Debit card from 2€ | |

| The application: | The application: | The application: | |

| – Fully online | – Fully online | – One visit in Tallinn required | |

| – Competitive FX Fees | – Accepting card payments and payments in online stores | ||

| – Payments via bank link |

Alternative Way: Purchase Ready Made European Company with VAT Registration

If starting a company from scratch seems like too much hassle and you’re looking for an alternative approach, consider acquiring an existing European company with VAT registration. This option allows you to bypass the lengthy process of setting up a new business and provides several advantages.

Exploring the Option of Acquiring an Existing European Company with VAT Registration

By purchasing a ready-made company, you can save significant time and effort. The process of establishing a new business can be complex, involving paperwork, legal requirements, and administrative tasks. However, when buying an existing company, many of these steps have already been completed by the previous owner.

Acquiring a ready-made European company with VAT registration gives you immediate access to the benefits that come with it. You can start conducting business transactions right away without having to wait for the registration process to be completed.

Advantages of Buying a Ready-Made Company

Understanding Legal Implications and Due Diligence Involved

When considering purchasing a ready-made European company with VAT registration, it’s crucial to understand the legal implications involved in such transactions. Conducting thorough due diligence is essential to ensure that there are no hidden liabilities or issues associated with the acquired entity.

Some key aspects to consider during due diligence include:

-

-

- Reviewing financial records: Carefully examining the financial statements and records of the company will help you assess its financial health and potential risks.

-

- Evaluating legal compliance: Ensuring that the company has complied with all local regulations, tax obligations, and licensing requirements is crucial to avoid any legal complications after acquisition.

- Assessing contractual agreements: Examining existing contracts, leases, and agreements will help you understand any ongoing commitments or obligations tied to the acquired company.

-

Ensuring Compliance with Local Regulations and Tax Obligations

After acquiring a ready-made European company with VAT registration, it’s essential to ensure ongoing compliance with local regulations and tax obligations. Familiarize yourself with the specific laws and requirements in the country where the company operates to avoid any penalties or legal issues.

-

-

- Register for local taxes: Even though the acquired company may already have VAT registration, you may need to register for other applicable taxes based on your business activities.

-

- Transfer ownership and licenses: Update all relevant licenses, permits, and registrations under your name as the new owner of the company.

- Comply with reporting requirements: Understand the reporting obligations imposed by local authorities and ensure timely submission of required documents.

-

Evaluating Cost-Effectiveness and Suitability

Before proceeding with purchasing a ready-made European company with VAT registration, it’s important to evaluate whether this alternative approach is cost-effective and suitable for your specific needs.

Consider these factors:

-

-

- Cost comparison: Compare the costs associated with starting a new business from scratch versus acquiring an existing one. Take into account not only initial expenses but also ongoing operational costs.

-

- Alignment with your goals: Assess how well an acquired company aligns with your business objectives, target market, industry experience, and growth plans.

- Scalability potential: Evaluate whether the acquired entity has room for growth or expansion in line with your long-term vision.

-

Register an EU Trademark for Your European Company and Claim SME Fund Grant

Congratulations on completing the sections before the conclusion! By now, you have gained valuable insights into starting your own European company online. You’ve learned about the benefits of registering a business in Europe, the step-by-step process of company registration, and even discovered Estonia as a favorable location for your venture. We discussed obtaining an e-Residency card and opening a bank account for your Estonian company. But that’s not all!

To take your European business to the next level, it’s crucial to protect your brand identity. Consider registering an EU trademark for your company. Not only does this safeguard your intellectual property rights across all member states but it also enhances credibility and trustworthiness among potential customers. Furthermore, by securing an EU trademark, you become eligible to claim grants from various Small and Medium-sized Enterprise (SME) funds available within the European Union.

Ready to make your mark in Europe? Take action today by exploring trademark registration options and unlocking potential funding opportunities through SME grants. Remember, establishing a strong brand presence is essential in today’s competitive market. So why wait? Start building a successful European business now!