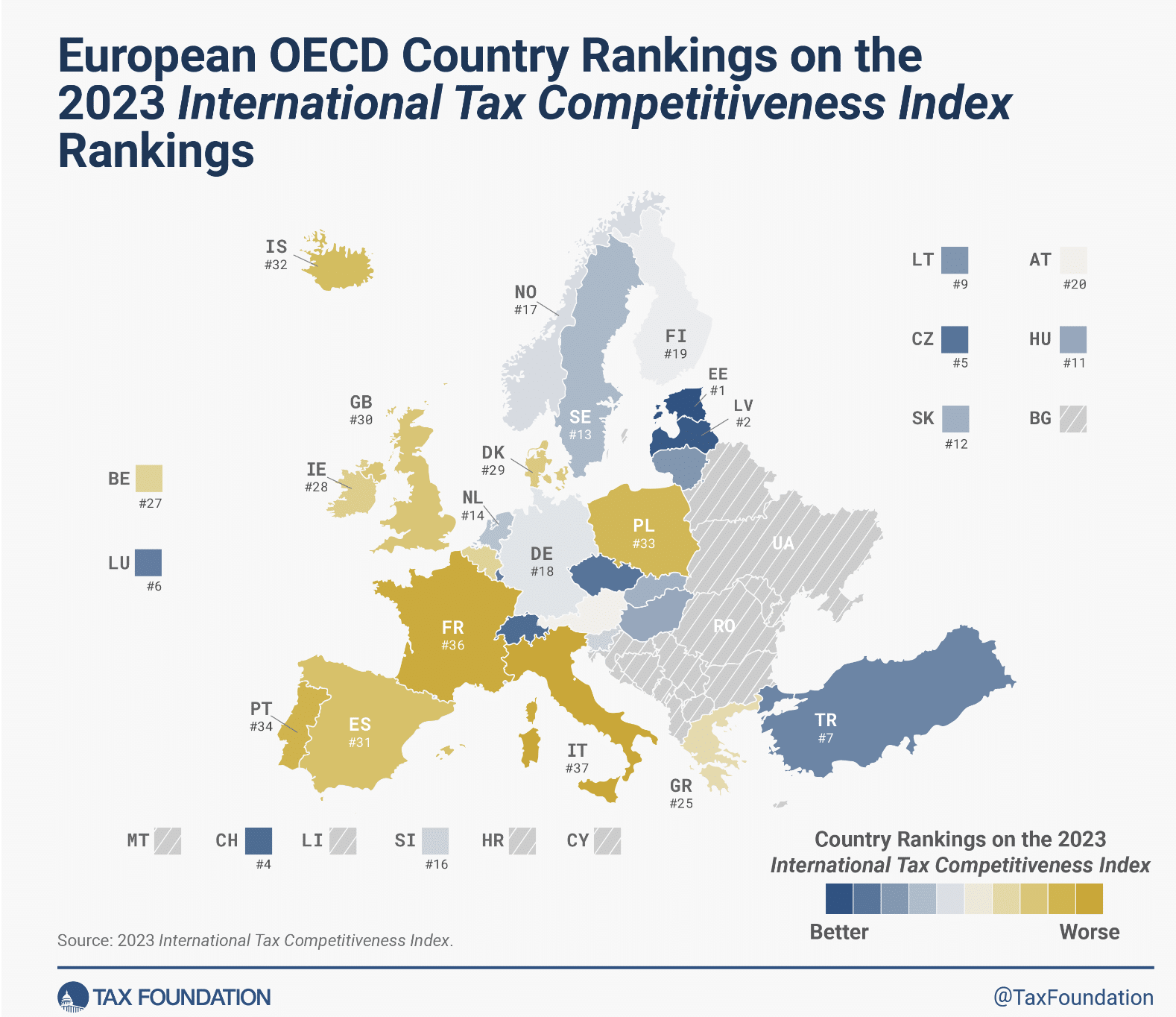

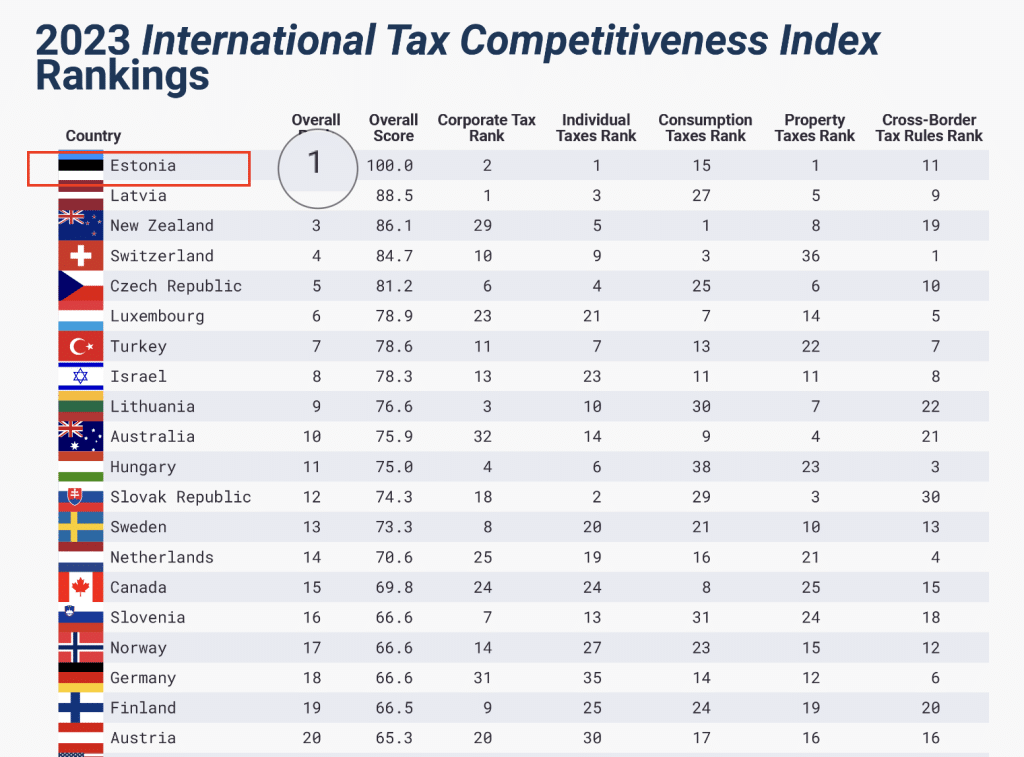

Estonia has the world’s best tax system [2023] – Tax Foundation Ranking

🌟 Estonian Tax System – Tax Foundation 2023 Ranking 🌟

According to the Tax Foundation, Estonia has the best tax system in the world! 🌍 And you know what? It’s all because of four awesome things about their tax code:

| Features of Estonia’s Tax System |

|---|

| 1. No tax on profits companies reinvest 📈 |

| 2. Flat 20% tax on individual income 💰 |

| 3. Property tax only on land value 🏡 |

| 4. No tax on foreign profits for Estonian companies 🌐 |

In simpler words, Estonia’s taxes are super easy to understand and follow. Companies spend only five hours a year dealing with taxes, compared to a whopping 42 hours in other countries! 😲 Plus, they don’t have annoying property transfer taxes like many other places do. No wonder it’s the best!

Low Tax Rates

Low tax rates also make Estonia a great place to do business. Businesses here can grow and create jobs because they don’t have to deal with high taxes eating up their profits. That’s why Estonia’s economy grew by 8.3% last year, way faster than other countries in Europe! 🚀

So, if you’re thinking about investing or starting a business, Estonia is the place to be. Their top-notch tax system will help you make the most of your money and beat those pesky inflation and energy prices! 💼💡